32+ Mortgage payment to income ratio

Ad Compare Mortgage Options Calculate Payments. Thats up from 24 at the end of 2021.

Idiosyncratic Whisk February 2019

LendingTree helps simplify financial decisions through choice education and support.

. Get The Service You Deserve With The Mortgage Lender You Trust. To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load is.

Take Advantage And Lock In A Great Rate. Apply Now With Quicken Loans. Before taxes Bob brings home 5000 a month.

Get The Service You Deserve With The Mortgage Lender You Trust. Ad Top-Rated Mortgage Lenders 2022. Your monthly debt payments would be as follows.

A mortgage payment adds up to 31 of median American household income according to Black Knight. Debt-to-income ratio for a VA loan. The ideal backend debt-to-income ratio for a VA loan including the proposed mortgage payment and monthly debts is anything under.

Get Your Estimate Today. See How Much You Can Save. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Get Your Estimate Today. 10250 month 300000 x 041 1650 a year12 months. Ad Get mortgage rates in minutes.

For example if you make 10000 every month multiply 10000 by 028 to get 2800. Debt-to-income ratio total monthly debt paymentsgross monthly income. Ad Learn More About Mortgage Preapproval.

You have a pretax income of 4500 per month. Your monthly expenses include 1200 for rent a. To determine how much you can afford using this rule multiply your monthly gross income by 28.

Lender Mortgage Rates Have Been At Historic Lows. Compare up to 5 free offers now. For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

Using a 300000 mortgage heres an example. A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. The 2836 rule is an addendum to the 28 rule.

Find the Best Mortgage Lender for You. Ad Mortgage Loan Low APR Top Lenders Comparison Free Online Offers. The Best Companies All In 1 Place.

Browse Information at NerdWallet. 1200 400 400 2000. Ad Compare Mortgage Options Calculate Payments.

Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI ratio of 037 or 37. For the high payment multiply the loan amount by 225. Compare Lowest Home Loan Lender Rates Today in 2022.

If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000. This includes credit cards car. Front-end debt ratio sometimes called mortgage-to-income ratio in the context of home-buying is computed by dividing total monthly housing costs by monthly gross income.

Apply Now With Quicken Loans.

Jackson Financial Inc 2021 Current Report 8 K

Economist S View Mean Vs Median Income Growth

2

3

3

Idiosyncratic Whisk Interest Rates And Home Prices

Idiosyncratic Whisk January 2020

1

Bmbu4jqq72husm

Idiosyncratic Whisk Housing Part 356 Black Homeownership

Idiosyncratic Whisk 2021

Mid Year Outlook 2022 Hurricane Or Storm Clouds A World In Transition

1

2

Idiosyncratic Whisk March 2019

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Balance Sheet Template Trial Balance

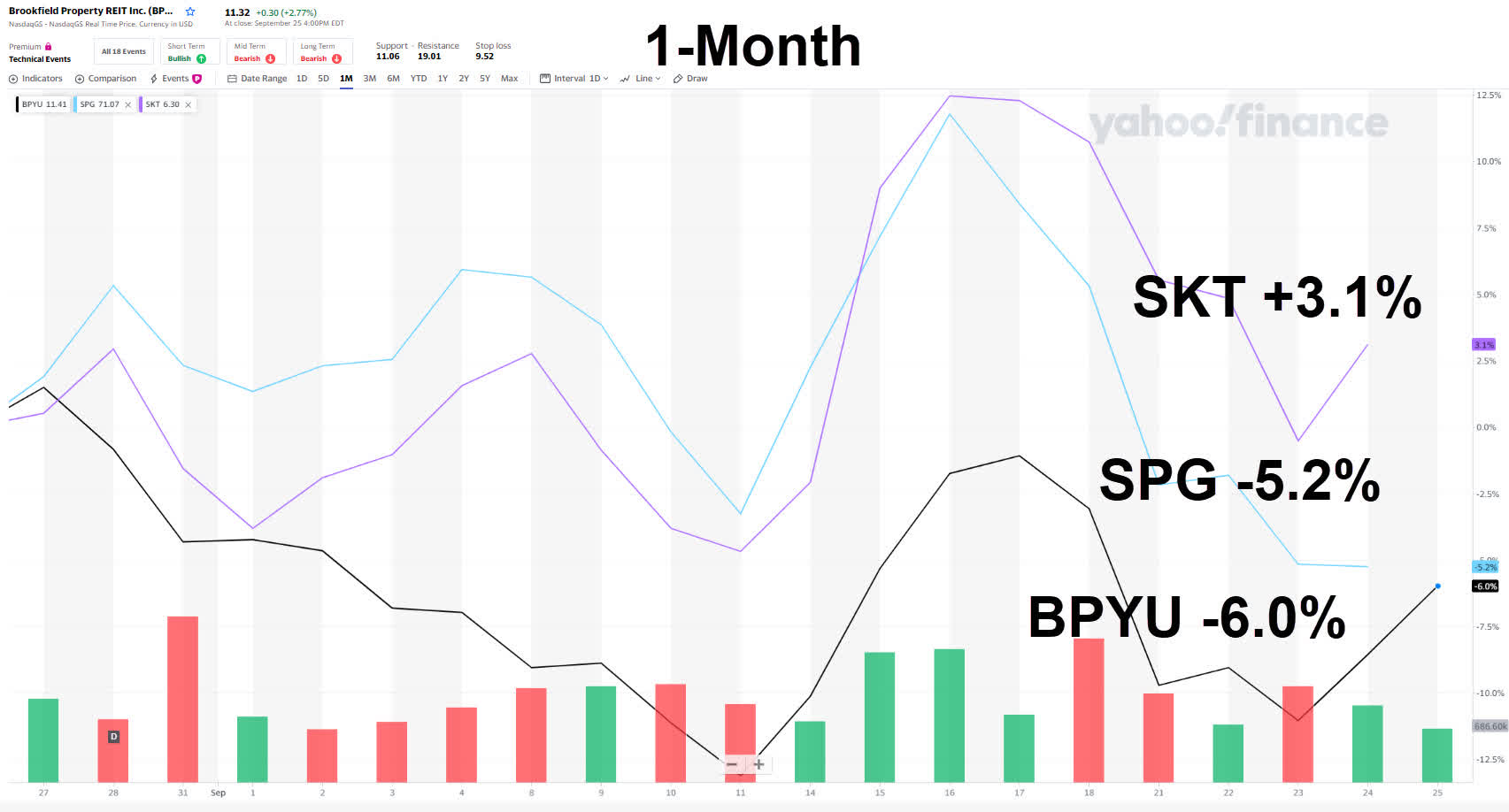

Brookfield Property S 12 Yield Is Screaming Buy Me Nasdaq Bpy Seeking Alpha